COOK PROTOCOL

Introduction

Traditionally, large-scale pension and mutual funds have dominated the asset management space. These funds have continued to increase their holdings of alternative investments other than stocks and bonds to seek higher profitability, including real estate, private equity, venture capital, and hedge funds. However, most of these investments are highly illiquid and opaque, so stakeholders are blind to allocations with no control over their money. Sadly, investors can only trust what their fund managers have told them about fund profitability.

The good news is that blockchain-based wealth management provides a more transparent alternative to traditional asset management. Instead of dealing with structural inefficiencies and hefty fees that are slanted towards wealthy institutional clients, blockchain-based solutions promise to open the traditional financial system to everyone, including asset managers and retail investors alike, by lowering entry barriers.

Currently, existing blockchain-based solutions are still in their early stages and oversimplified, struggling to provide trustworthy and flexible investing and management vehicles to satisfy a wide range of needs. This struggle is why Cook Protocol is joining the financial revolution — providing access to its leading financial management platform for everyone.

About Cook Protocol

Cook Protocol is built on Ethereum blockchain that establishes a generic asset management platform, providing investors with a selection of asset management vehicles from fund managers.

Funds can be managed passively or actively through whitelisted DeFi protocols.

For each investment fund, a unique ERC-20 token proportional to their contribution to the fund, is issued to investors.

Investors can divest the tokens anytime in exchange for the equivalent underlying asset.

An investor invests crypto assets accepted by a particular fund in exchange for ERC20 tokens representing partial ownership of the fund.

This ERC-20 token, or ckToken, is unique to each fund and can be exchanged among investors or redeemed for its underlying assets inside the fund.

The concept of a ckToken is similar to a share in the stock market, especially with financial products such as Exchange Traded Funds (ETFs).

Thus, a ckToken equates to a percentage of ownership in an investment fund, with its value being proportional to the investment fund’s value.

For each investment fund, its ERC-20 tokens become fungible assets that can then be traded among investors, providing convenience and reducing transaction fees.

A fund manager initializes a fund by defining an overall strategy and fee structure, accepting assets and access limits to each of the whitelisted DeFi protocols.

Cook Protocol allows fund managers to describe investment strategies to attract suitable investors.

Funds are then pooled from investors into a smart contract so that the fund manager can allocate passively, following a specific index, or actively, managing multiple financial product streams.

For each investment fund, the fund manager is granted with the proper permissions according to the smart contract, which allows the manager to allocate funds to the whitelisted DeFi protocols, such as Compound, 0x, and Synthetix.

The amount of funds allocated to each DeFi protocol cannot exceed a pre-determined limit and can only be revised through fund-level governance.

In return for providing asset management services, the fund manager is compensated through a fee-based model, where investors take all gains and losses while paying a fixed fee to the fund manager.

While each transaction within the fund market is transparent, the actual investment strategy can remain opaque to the outside world to spur innovation.

By default, fund managers will pay 2% when they claim the management fees.

Fund managers do not need to pay platform fees if they decide to withdraw their management fees in COOK tokens.

100% of the platform fees are then redistributed to COOK token holders who actively contribute to our ecosystem.

The platform fees are subject to change by the community governance in the future.

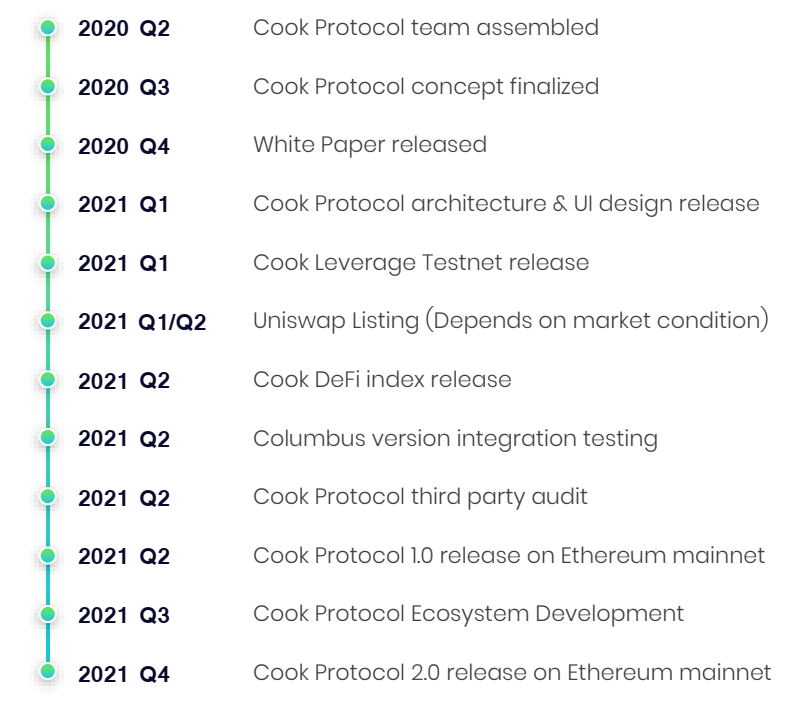

Roadmap

Token Information

Token Name: COOK

Token Type: ERC20 Ethereum

Token Price: $0.025

Total Supply: 10,000,000,000 COOK

* What is Cook (COOK) token used for?

COOK tokens are governance tokens that can accomplish a variety of updates on the protocol.

1. Update DeFi Whitelist

The entire community of Cook token holders can decide whether to add or remove a particular DeFi protocol to the protocol-level whitelist

2. Adjust Platform Fee

Cook token holders can decide to increase or decrease fees charged on the Cook Protocol platform.

3. Modify Governance Model

If token holders are unsatisfied with the current governance model, they can propose modifications to better serve their interests.

4. Change Pricing Oracle

Cook Protocol uses a price oracle to calculate the investment fund values. Token holders can vote to have the price oracle updated.

5. Add New Features

Cook tokens can also be used to vote on adding features at the protocol-level.

Token Distribution

1. Mining: 60%

Part of the tokens is reserved for mining rewards.

2. Community Incentive & Airdrop: 10%

Part of the tokens is used to bootstrap the ecosystem.

3. Early Community: 10%

Tokens reserved for private sale to early community members willing to contribute to our ecosystem.

4. Business & Media Partnership 10%

Rewards for marketing and partnership.

5. Team 10%

Tokens allocated to the core developers and team members on a price-based release schedule after a 90-day cliff.

Features

Cook Protocol will tap into the crypto asset management market, which is currently valued at hundreds of billions of dollars and is growing exponentially. Cook Protocol allows investors to select appropriate investment choices provided by fund managers. We provide investors with a sleek and straightforward interface and fund managers with powerful trading tools.

Investors

- User-friendly UI: A simple, sleek interface to help users navigate through sophisticated DeFi land

- Investment variety: Index-based and actively-managed funds

- Security & transparency: Fund security and information transparency guaranteed by smart contract

Asset Manager

- Lower initialization fees: The elimination of hefty legal and various fees to begin fund management and receive money from investors

- Professional trading tools: Access to various blockchain-based money markets and trading tools, such as the token price predictive model

- IP protection: No need to open-source investment strategies

1. Adrian Peng (CEO)

Graduated from UC Berkeley with four years of experience in the blockchain space. Early investor in crypto projects, including Ethereum, Polkadot, and Filecoin. Tech lead at Google and Oracle. Currently managing frontend & backend development while overseeing the overall product roadmap.

2. Cage Chen (CTO)

Top 1% graduate from Carnegie Mellon University and a Silicon Valley engineering veteran. Lead engineer at several top Silicon Valley companies, such as DropBox and C3.AI. Currently serves as tech lead on frontend & backend development.

3. KP Peng (Strategy Lead)

Stanford Engineering School Graduate. Product manager from United Technologies Corporation. Fluent in 6 languages. Has successfully delivered multiple large-scale projects in both corporate America and start-ups. 4 years of experience in the blockchain space.

4. Matias Dominguez (CMO)

Graduated from Macquarie University. 5+ years of experience in marketing, community management and growth hacking in English and Spanish worlds. 3+ years in blockchain industry.

5. Ace Yin (COO)

UPenn CS graduate. Product manager from Youtube. Five-plus years of experience in technology operations. Very familiar with the operations in big tech companies and high-growth startups.

6. Michael Bader (CFO)

Serial entrepreneur. Ten-plus years of experience in fintech and three years in blockchain. Very passionate about how DeFi can revolutionize the finance sector.

7. Antonio Wong (VP of Blockchain Development)

Senior developer at Wayfair and graduate of Cornell University. Mined first bitcoin in 2013 with seven years of experience in blockchain. Currently working as senior blockchain developer focused on smart contract development.

8. Rahul Rodrigues (Chief Architect)

Fifteen years of experience in software development primarily focused on distributed systems. Former architect at several fintech companies, including Fidelity Investments. Currently focused on smart contract architecture design.

To register and get more information please visit below link :

- Website: https://www.cook.finance

- Twitter: https://twitter.com/cook_finance

- Telegram: https://t.me/cook_english

- LinkedIn: https://www.linkedin.com/company/cook-finanace/

- Reddit: https://www.reddit.com/r/CookProtocol/

- YouTube: https://www.youtube.com/channel/UCGiAQqspfq9LE0XgFlywN7w

- Github: https://github.com/CookFinance

Komentar

Posting Komentar